CBP7501 Example

Click on the hotspots below to learn more about each block of the 7501

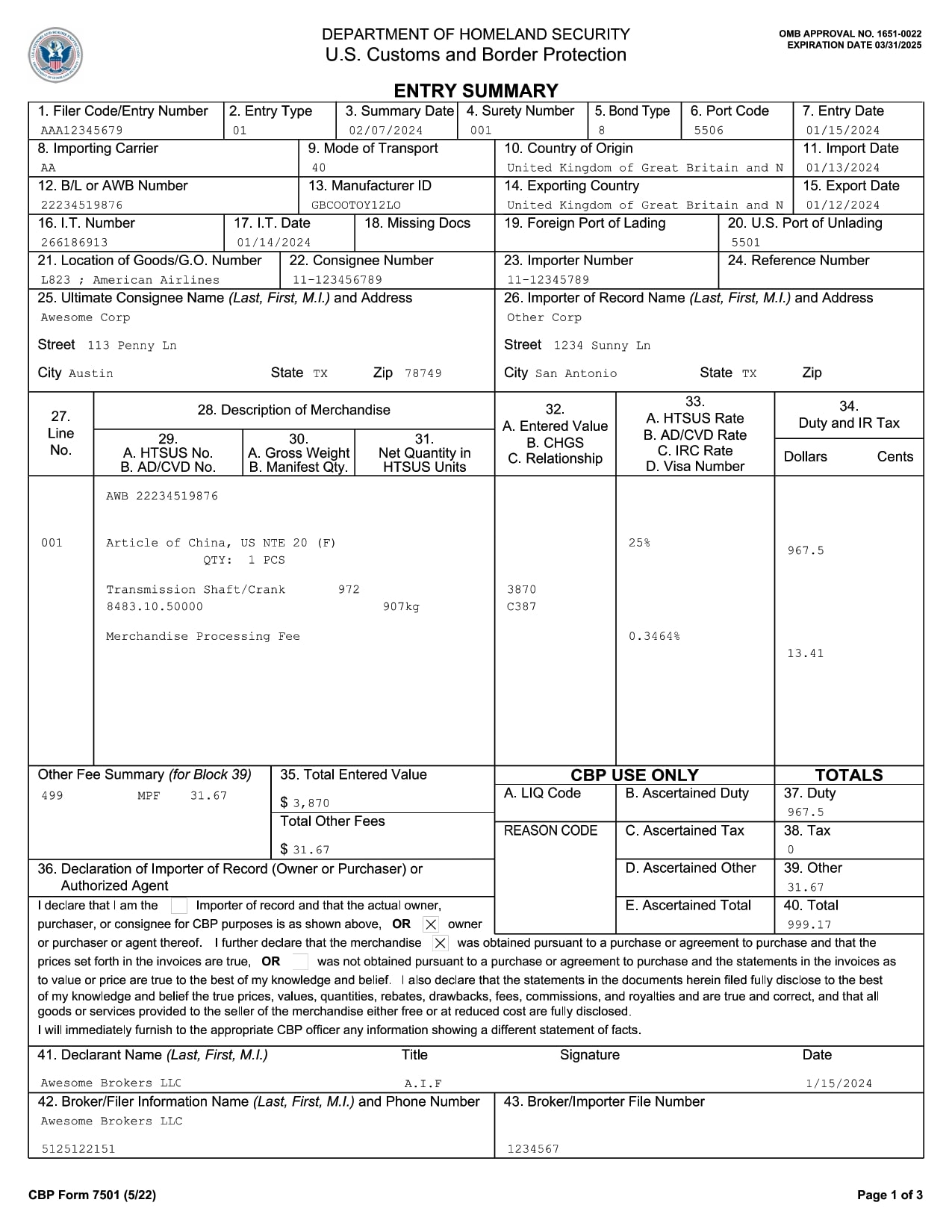

BLOCK 2) ENTRY TYPE Record the appropriate entry type code by selecting the two-digit code for the type of entry summary being filed. The first digit of the code identifies the general category of the entry (i.e., consumption = 0, informal = 1, warehouse = 2). The second digit further defines the specific processing type within the entry category. The following codes shall be used: Consumption Entries Note: When the importer of record of emergency war materials is not a government agency, entry type codes 01, 02, 03, etc., as appropriate, are to be used. Automated Broker Interface (ABI) processing requires an ABI status indicator. This indicator must be recorded in the entry type code block. It is to be shown for those entry summaries with ABI status only, and must be shown in one of the following formats: A "LIVE" entry is when the entry summary documentation is filed at the time of entry with estimated duties. Warehouse withdrawals are always considered “LIVE” entries. When a “LIVE” entry/entry summary is presented, an additional indicator is required to be shown in the following formats: BLOCK 1) ENTRY NUMBER Record the 11-digit alphanumeric code. The entry number is comprised of the three-digit filer code, followed by the seven-digit entry number, and completed with the one-digit check digit.

Entry Filer Code represents the three-character alphanumeric filer code assigned to the filer or importer by CBP. Entry Number represents the seven-digit number assigned by the filer. The number may be assigned in any manner

convenient, provided that the same number is not assigned to more than one CBP Form 7501. Leading zeros must be shown. Check digit is computed on the previous 10 characters. The formula for calculating the check digit can be found in Appendix 1. BLOCK 3) SUMMARY DATE Record the month, day, and year (MM/DD/YYYY) on which the entry summary is filed with CBP. The record copy of the entry summary will be time stamped by the filer at the time of presentation of the entry summary. In the case of entry summaries submitted on an ABI statement, only the statement is required to be time stamped. This block should not be printed or typed prior to presentation of the entry/entry summary. Use of this field is optional for ABI

statement entries. The time stamp will serve as the entry summary date. The filer will record the proper team number designation in the upper right portion of the form above this block (three-character team number code). For ABI entry summaries, the team number is supplied by CBP’s automated system in the summary processing output message. Record the three digit numeric code that identifies the surety company on the Customs Bond. This code can be found in block

7 of the CBP Form 301, or is available through CBP’s automated system to ABI filers, via the importer bond query transaction. For U.S. Government importations and entry types not requiring surety, code 999 should appear in this block. When cash or Government securities are used in lieu of surety, use code 998. Record the single digit numeric code as follows: Bond type "0" should be used in conjunction with surety code "999" for government entries secured by stipulation as provided for in 19 C.F.R. § 10.101(d). Bond type "8" or "9," as appropriate, should be used in conjunction with surety code "998" when cash or government securities are deposited in lieu of surety. Bond type "9" should be used in conjunction with surety code "999" when surety has been waived in accordance with 19 C.F.R. § 142.4 (c). A single entry bond should be attached to the entry summary package. Record the U.S. port code utilizing the Schedule D, Customs District and Port Codes, listed in Annex C of the Harmonized Tariff Schedule (HTS). The port is where the merchandise was entered under an entry or released under an immediate delivery permit. Use the following format: DDPP (no spaces or hyphens). Record the month, day, and year (MM/DD/YYYY) on which the goods are released, except for immediate delivery, quota goods, or where the filer requests another date prior to release (see 19 C.F.R. § 141.68). It is the responsibility of the filer to ensure that the entry date shown for entry/entry summaries is the date of presentation (i.e., the time stamp date). The entry date for a warehouse withdrawal is the date of withdrawal. For merchandise arriving in the U.S. by vessel, record the name of the vessel that transported the merchandise from the foreign port of lading to the first U.S. port of unlading. Do not record the vessel identifier code in lieu of the vessel name. Pursuant to General Statistical Note 1 (a) (ii) of the HTS, the reporting of the vessel flag is not required. For merchandise arriving in the U.S. by air, record the two-digit IATA alpha code corresponding to the name of the airline which transported the merchandise from the last airport of foreign lading to the first U.S. airport of unlading. If the carrier file does not contain a specific air carrier's code, write the designation "*C" for Canadian airlines, "*F" for other foreign airlines, and "*U" for U.S. airlines. These designations should be used only for unknown charter and private aircraft. When a private aircraft is being entered under its own power (ferried), the designation "**" will be used. For merchandise arriving in the U.S. by means of transportation other than vessel or air, leave blank. Do not record the name of a domestic carrier transporting merchandise after initial lading in the U.S.

For merchandise arriving in the customs territory from a U.S. Foreign Trade Zone (FTZ), insert "FTZ" followed by the FTZ

number. Use the following format: FTZ NNNN Record the mode of transportation by which the imported merchandise entered the U.S. port of arrival from the last foreign country utilizing the following two-digit numeric codes: Record the country of origin utilizing the International Organization for Standardization (ISO) country code located in Annex B of the HTS. The country of origin is the country of manufacture, production, or growth of any article. If the article consists of material produced, derived from, or processed in more than one foreign territory or country, or insular possession of the U.S., it shall be considered a product of that foreign territory or country, or insular possession, where it last underwent a substantial transformation. For reporting purposes only on the CBP Form 7501, whenever merchandise has been returned to the U.S. after undergoing repair, alteration, or assembly under HTS heading 9802, the country of origin should be shown as the country in which the repair, alteration, or assembly was performed. When merchandise is invoiced in or exported from a country other than that in which it originated, the actual country of origin shall be specified rather than the country of invoice or exportation. When an entry summary covers merchandise from more than one country of origin, record the word "MULTI" in this block. In column 27, directly below the line number, prefixed with the letter "O," indicate the ISO code corresponding to each line item. Where line items are segregated by invoice, indicate the ISO code corresponding to each invoice. The ISO country code “CA” for Canada for goods of Canadian Origin will no longer be reported as a country of origin. As of May 15, 1997, the Canadian Province codes will replace the code “CA”. The following conditions in which the “CA” is acceptable, in addition to the Province Codes: Additional information related to reporting the correct ISO country code for goods of Canadian Origin can be found in

CSMS# 97-000267 and 02-000071 For merchandise arriving in the U.S. by vessel, record the month, day, and year (MM/DD/YYYY) on which the importing vessel transporting the merchandise from the foreign country arrived within the limits of the U.S. port with the intent to unlade. For merchandise arriving in the U.S. other than by vessel, record the month, day, and year (MM/DD/YYYY) in which the merchandise arrived within the U.S. port limits. For merchandise entering the customs territory for consumption from a U.S. FTZ, in compliance with 19 C.F.R. § 146.63, if the import date is not the date of removal from the zone, leave blank. For merchandise moving from a U.S. FTZ to a bonded warehouse in the customs territory, in compliance with 19 C.F.R. §

146.64, report the month, day, and year (MM/DD/YYYY) of importation. Record the number assigned on the manifest by the international carrier delivering the goods to the U.S. Each B/L number for vessel or rail shipments must conform to a unique format comprised of 2 elements. The first element comprises the first four characters of the unique bill number, and is the Standard Carrier Alpha Code (SCAC) of the bill’s issuer. The second element may be any length up to a maximum 12 characters and may be alpha and/or numeric. Use the following format: ABCD1234567 If multiple bills are associated with an entry summary, list additional B/L or AWB numbers across the top of column 28 or on a separate attachment. This block is provided to accommodate the manufacturer/shipper identification code. This code identifies the manufacture/ shipper of the merchandise by a constructed code. The method for deriving the code can be found in Appendix 2. For the purposes of this code, the manufacturer should be construed to refer to the invoicing party or parties (manufacturers or other direct suppliers). The name and address of the invoicing party, whose invoice accompanies the CBP entry, should be used to construct the MID. The manufacturer/shipper identification code is required for all entry summaries and entry/entry summaries, including informal entries, filed on the CBP Form 7501. For textile shipments, the manufacturer should be construed to refer to the actual manufacturer in accordance with 19 CFR

102.23(a) and the Appendix to 19 CFR Part 102 – Textile and Apparel Manufacturer Identification.

Non-textile shipments may use the invoicing party or parties (manufacturers or other direct suppliers). When an entry summary covers merchandise from more than one manufacturer, record the word "MULTI" in this block. In column 28, indicate the MID Code corresponding to each line item. If there is more than one vendor for a particular HTS number, separate line items will be required for each MID. Record the exporting country utilizing the ISO country code located in Annex B of the HTS. The country of exportation is the country of which the merchandise was last part of the commerce and from which the merchandise was shipped to the U.S. without contingency of diversion. When an entry summary covers merchandise from more than one country of export, record the word "MULTI" in this block. In column 27, directly below the line number, prefixed with the letter "E," indicate the ISO code corresponding to each line item. Where line items are segregated by invoice, indicate the ISO code corresponding to each invoice. For merchandise entering the customs territory from a U.S. FTZ, if multiple countries of export are involved, indicate the country of export with the greatest value. In the case where the merchandise is U.S. goods returned and the filer opts to pay the duty and report only the Chapter 1 - 97 HTS number, report the country of invoice or exportation. Country of export U.S. will not be acceptable when country of origin is U.S. For merchandise exported by vessel, record the month, day, and year (MM/DD/YYYY), on which the carrier departed the last port in the exporting country. For merchandise exported by air, record the month, day, and year (MM/DD/YYYY), on which the aircraft departed the last airport in the exporting country. For overland shipments from Canada or Mexico and shipments where the port of lading is located outside the exporting country (e.g., goods are exported from Switzerland but laden and shipped from Hamburg, Germany), record the month, day, and year (MM/DD/YYYY), that the goods crossed the border of the exporting country (Switzerland in this example). For mail shipments, record the month, day, and year (MM/DD/YYYY) of export as noted on the Notice to Addressee, CBP Form

3509. For goods entering the customs territory from a U.S. FTZ, leave blank. When an entry summary covers merchandise with more than one date of export, record the word "MULTI" in this block. In column 27, directly below the line number, indicate the date corresponding to each line item. Where line items are segregated by invoice, indicate the date corresponding to each invoice. For textile merchandise, refer to additional requirements listed under VISA NUMBER/CERTIFICATE OF ELIGIBILITY/EXPORT CERTIFICATE in Column 33(d) instructions. Record the IT number obtained from the CBP Form 7512, AWB number from the Transit Air Cargo Manifest (TACM), or

Automated Manifest System (AMS) master in-bond (MIB) movement number. When an entry summary covers merchandise with more than one IT, place additional IT numbers and associated IT dates across the top of column 28 or on a separate attachment. If merchandise moves on an IT into a U.S. FTZ, the IT number need not be recorded on the CBP Form 7501 when the merchandise is removed from the zone. Record the month, day, and year (MM/DD/YYYY), obtained from the CBP Form 7512, TACM, or AMS MIB record. When an entry summary covers merchandise with more than one IT, place additional IT numbers and associated IT dates across the top of column 28 or on a separate attachment. Note: IT date cannot be prior to import date. Record the appropriate document code number(s) to indicate documents not available at the time of filing the entry summary. A maximum of two codes may be used. The bond charge should be made on the entry summary only for those documents required to be filed with the entry summary. The following codes shall be used: If a document has been waived prior to entry summary filing or is not required at time of entry summary, it should not be recorded as a missing document. Be aware that the following forms cannot be waived and filers shall be obligated to file the forms within the appropriate time limits: For merchandise arriving in the U.S. by vessel, record the five digit numeric code listed in the “Schedule K” (Classification of Foreign Ports by Geographic Trade Area and Country) for the foreign port at which the merchandise was actually laden on the vessel that carried the merchandise to the U.S. The “Schedule K” may be retrieved at: http://www.iwr.usace.army.mil/ndc/wcsc/scheduleK/schedulek.htm If the actual port name is not provided, use the code for "all other ports" for the country in which the merchandise was laden on the vessel that carried the merchandise to the U.S. When an entry summary covers merchandise with more than one foreign port of lading, record the word "MULTI" in this block. In column 27, directly below the line number, indicate the code corresponding to each line item. When line items are segregated by invoice, indicate the code corresponding to each invoice. When merchandise is transported by a mode of transportation other than vessel, leave blank. For merchandise entering the customs territory from a U.S. FTZ, leave blank. Record the U.S. port code where the merchandise was unladen from the importing vessel, aircraft or train. Do not show the name of the port instead of the numeric code. For merchandise arriving in the U.S. by means of transportation other than vessel, rail or air, leave blank. For merchandise arriving in the customs territory from a U.S. FTZ, leave blank. Where the entry summary serves as entry/entry summary, record the pier or site where the goods are available for examination. For air shipments, record the flight number. Where the Facilities Information and Resources Management (FIRMS) codes are available, they must be used in lieu of pier/site. Where the entry summary is used for merchandise that has been placed in GO, record the number assigned by CBP in the following format: G.O. NNNNNNNNNNNN Where the entry summary is used for merchandise placed in a bonded warehouse, record the name and the FIRMS code of the bonded warehouse where the goods will be delivered. Record the Internal Revenue Service (IRS) Employee Identification Number (EIN), Social Security Number (SSN), or CBP

assigned number of the consignee. This number must reflect a valid identification number filed with CBP via the CBP Form

5106 or its electronic equivalent. When the consignee number is the same as the importer of record number, the word

"SAME" may be used in lieu of repeating the importer of record number. Only the following formats shall be used: For consolidated shipments, enter zeros in this block in the IRS EIN format shown above (i.e., 00-0000000). The reporting of zeros on the entry summary is limited to consolidated shipments and consolidated entry summaries. Record the IRS EIN, SSN, or CBP assigned number of the importer of record. Proper format is listed under the instructions for

Consignee Number. Record the IRS EIN, SSN, or CBP assigned number of the individual or firm to whom refunds, bills, or notices of extension or suspension of liquidation are to be sent (if other than the importer of record and only when a CBP Form 4811 is on file). Proper format is listed under the instructions for Consignee Number. Do not use this block to record any other information. At the time of Entry Summary, record the name and address of the individual or firm purchasing the merchandise or, if a consigned shipment, to whom the merchandise is consigned. If those parties are not known, indicate to whose premises the merchandise is being shipped. If this information is the same as the importer of record, leave blank. Note: For express consignment shipments and land border shipments, at the time of Entry Summary, record the name and address of the individual or firm for whose account the merchandise is shipped. The account of party is the actual owner, who is holder of title to the goods. In the space provided for indicating the state, report the ultimate state of destination of the imported merchandise, as known at the time of entry summary filing. If the contents of the shipment are destined to more than one state or if the entry summary represents a consolidated shipment, report the state of destination with the greatest aggregate value. If in either case, this information is unknown, the state of the ultimate consignee, or the state where the entry is filed, in that order, should be reported. However, before either of these alternatives is used, a good faith effort should be made by the entry filer to ascertain the state where the imported merchandise will be delivered. In all cases, the state code reported should be derived from the standard postal two-letter state or territory abbreviation. On a warehouse withdrawal, the original warehouse entry number should be recorded at the bottom of this block. Record the name and address, including the standard postal two-letter state or territory abbreviation, of the importer of record. The importer of record is defined as the owner or purchaser of the goods, or when designated by the owner, purchaser, or consignee, a licensed customs broker. The importer of record is the individual or firm liable for payment of all duties and meeting all statutory and regulatory requirements incurred as a result of importation, as described in 19 C.F.R. § 141.1(b). The importer of record shown on the invoice should be the same party on the CBP Form 7501, unless the CBP form reflects a licensed customs broker. Record the appropriate line number, in sequence, beginning with the number 001. A "line number" refers to a commodity from one country, covered by a line which includes a net quantity, entered value, HTS number, charges, rate of duty and tax. However, some line numbers may actually include more than one HTS number and value. For example, many items in Chapter 98 of the HTS require a dual HTS number. Articles assembled abroad with U.S. components require the HTS number 9802.00.80 along with the appropriate reporting number of the provision in Chapters 1 through 97. Also, many items in Chapter 91 of the HTS require as many as four HTS numbers. Watches classifiable under subheading

9101.11.40, for example, require that the appropriate reporting number and duty rate be shown separately for the movement, case, strap, band or bracelet, and battery. A separate line item is also required for each commodity that is the subject of a Customs binding ruling. Proper format is listed under the instructions for HTS number. Where a reporting number is preceded by an alpha character designating a special program (i.e., NAFTA = “CA” or “MX”; GSP

= “A”), that indicator is to be placed in column 27, directly below the line number. The special program indicator (SPI) should be right justified on the same line and immediately preceding the HTS number to which it applies. If more than one HTS number is required for a line item, place the SPI on the same line as the HTS number upon which the rate of duty is based.

If more than one SPI is used, the primary indicator that establishes the rate of duty is shown first, followed by a period and the secondary SPI immediately following. If "MULTI" was recorded in block(s) 10, 14, 15, and/or 19, the appropriate codes or dates are to be shown in column 27 below the SPI. See specific instructions for those items with multiple elements. A description of the articles in sufficient detail to permit the classification thereof under the proper statistical reporting number in the HTS should be reported at the top of column 28. The standard definitions from the CBP HTS database are acceptable for this requirement. For a warehouse withdrawal, all copies of the CBP Form 7501 must be clearly marked “WAREHOUSE WITHDRAWAL FOR CONSUMPTION” at the top of column 28, followed by the words “FINAL WITHDRAWAL” if applicable. Next will be the “Bonded Amount” (quantity in the warehouse account before the withdrawal), “Withdrawal” (quantity being withdrawn), and “Balance” (quantity remaining in warehouse after withdrawal), as required in 19 C.F.R. § 144.32(a). Transfer of the right to withdraw the merchandise included on the CBP Form 7501 will be established by including the name, and hand-written or facsimile signature of the person primarily liable for payment of duties before the transfer is completed. This endorsement should be shown after the “Balance” in column 28. When there is deferred tax paid by electronic funds transfer (EFT), the following statement is required in this section: If the deferred tax will not be paid by EFT, the words “DEFERRED TAX” should show after the words “WAREHOUSE WITHDRAWAL FOR CONSUMPTION” at the top of this block. Do not record the column heading letters, only the required data in the proper format. Record the appropriate full 10-digit HTS item number. This item number should be left justified. Decimals are to be used in the 10-digit number exactly as they appear in the HTS. Use the following format: 4012.11.4000 If more than one HTS number is required, follow the reporting instructions in the statistical head note in the appropriate HTS section or chapter. Where an SPI is required for an HTS number, see Column 27 instructions. For each item covered by a binding tariff classification ruling, report the ruling number (provided in the applicable ruling letter) directly below the HTS number of the appropriate line item. Precede the ruling number with the abbreviation "RLNG." For an item classified under the same tariff classification number but not specifically covered by the binding tariff classification ruling, provide a separate line item breakout for that item. For those line items that require the reporting of more than one data element (i.e. category number and/or manufacturer identification number) in this same area, the hierarchy should be as follows: The correct format for reporting a ruling number or pre-approval indicator are listed below, respectively: For sets, which are classifiable in accordance with GRI 3(b) or 3(c) of the HTS, report in column 30 the HTS number from which the rate of duty for the set is derived. Precede this number with an SPI of "X." Report with that part of the set so classified the total value, quantity and charges associated with the set, as well as all applicable duties, taxes, and fees, in the appropriate columns. In addition, each article in the set (including the article designated with a prefix of "X") should be reported on a separate line as if it were separately classified. Precede these HTS numbers with an SPI of "V." Report the quantity and value attributed to each article associated with the "V" SPI. All other reporting requirements including, but not limited to, quota, visa, licensing, and other government agency requirements, should be reported along with the appropriate HTS number preceded with an SPI of "V." Both the "X" and "V" should be right justified in column 27, immediately preceding, and on the same line as the HTS number to which it applies. Directly below the HTS number, indicate the appropriate AD/CVD case number(s), as assigned by the Department of

Commerce, International Trade Administration. The following format shall be used: Case numbers with a suffix of 000 (ex. A-000-000-000) should only be used when the manufacturer and/or exporter falls under the “All Other” or country wide provisions of the AD/CVD case. The application of case numbers should follow this hierarchy under the following circumstances: When bonding is permitted and used, record the phrase "Surety Code" and the surety number [e.g., (Surety Code

#123)]. If cash or government securities are deposited in lieu of surety, record "Surety Code #998." Directly below the HTS number record the textile category for each separate line, as applicable. Use the following format: CAT NNN Directly below the pertinent line information, on the same line as the applicable rate in column 33, identify any other fee, charge or exaction that applies. Examples include the beef fee, honey fee, pork fee, cotton fee, harbor maintenance fee (HMF), sugar fee, and merchandise processing fee (MPF). All fees, with the exception of the HMF, are to be reported at the line item level. The HMF may be shown either at the line item level or once at the bottom of column 29 on the first page of the summary. Do not record the column heading letters, only the required data in the proper format. Report gross shipping weight in kilograms for merchandise imported by ALL modes of transportation. The gross weight must be reported on the same line as the entered value.

In cases where more than one value is shown on a line item, record the gross weight on the same line as the first tariff number for the line item. Gross weight information must be provided for each line item. If the gross weight is not available for each line item, the approximate shipping weight shall be estimated and reported. The total of the estimated weights should equal the actual gross shipping weight. For multi-line summaries, the grand total gross weight need not be shown. In the case of containerized cargo carried in lift vans, cargo vans, or similar substantial outer containers, the weight of such container should not be included in the gross weight of the merchandise. Where the entry summary serves as entry/entry summary, indicate the manifest quantity reported on the B/L or AWB. If multiple bills are associated with an entry/entry summary, indicate the manifest quantity reported on the B/L or AWB

with the appropriate B/L or AWB number listed across the top of column 28. When a unit of measure is specified in the HTS for an HTS number, report the net quantity in the specified unit of measure, and show the unit of measure after the net quantity figure. Record quantities in whole numbers for statistical purposes unless fractions of units are required for other CBP purposes. Fractions must be expressed as decimals. When an "X" appears in the column for units of quantity, no quantity is to be reported in column 31. (Gross weight must still be reported in Column 30.) When two units of measure are shown for the same article, report the net quantity for both in the specified unit of measure.

The value of the article is to be reported with the first unit of measure unless a "V" follows the second which indicates the value of the article is to be reported with that unit of measure. Example: Shipment consists of 50 dozen t-shirts, weighing 1 kg per dozen and valued at $10 per dozen. Report as follows: COLUMN 29 | COLUMN 30 | COLUMN 31 6205.20.2065 | 50 doz.| 500 |50 kgs | Do not record the column heading letters, only the required data in the proper format.

A. ENTERED VALUE

Record the U.S. dollar value as defined in 19 U.S.C. § 1401a for all merchandise. Record the value for each line item on the same line as the HTS number.

If the value required for assessment of AD/CVD is different from the entered value, record in parentheses the amount in this column, on the same line as the AD/CVD case number and rate. If the reported value is not the transaction value it should later be reported under a Reconciliation Entry (Type 09), if approved for reconciliation, or other alternate means. Report the value in whole dollars rounded off to the nearest whole dollar (if the total entered value for a line item is less than 50 cents report as "0"). Dollar signs are omitted. Report the total entered value for all line items in block 35. Record the aggregate cost in U.S. dollars of freight, insurance and all other charges, costs and expenses incurred while bringing the merchandise from alongside the carrier at the port of exportation in the country of exportation and placing it alongside the carrier at the first U.S. port of entry. Do not include U.S. import duties. In the case of overland shipments originating in Canada or Mexico, such costs shall include freight, insurance, and all other charges, costs

and expenses incurred in bringing the merchandise from the point of origin (where the merchandise begins its journey to the United States) in Canada or Mexico to the first U.S. port of entry. This value shall be shown in whole numbers for each HTS number. It is to be placed beneath the entered value and identified with the letter ‘C’ (e.g., C550). Dollar signs are omitted. Charges are not required to be reported for merchandise entered by mode of transportation code 60 (passenger, hand-carried).” Record whether the transaction was between related parties, as defined in 19 C.F.R. § 152.102(g), by placing a "Y" in the column for related and an "N" for not related (the words "related" and "not related" may be used in lieu of "Y" or "N"). "Y" or "N" may be recorded once, at the top of column 32, when applicable to the entire entry summary or may be recorded with each line item below entered value and charges. "Y" or "N" must be recorded with each line item when the relationship differs for line items. Do not record the column heading letters, only the required data in the proper format. Record the rate(s) of duty for the classified item as designated in the HTS: free, ad valorem, specific, or compound. COLUMN 29 | COLUMN 33 6201.19.1010 Free | 6201.19.9060 2.8% Record the AD/CVD rate(s) as designated by the Department of Commerce, International Trade Administration, directly opposite the respective AD/CVD case number(s) shown in column 29. Record the tax rate(s) for the classified item as designated in the HTS, or record the CBP approved metric conversion tax rate. If I.R. tax is deferred, precede I.R.C. rate with "DEF." Show the amount in column 34 and in block 38 but do not include in the "Total" in block 40. Deferred I.R. tax under 26 U.S.C. § 5232(a) should be identified as "IRS DEF 5232(a)," at the bottom of columns 33 and 34 on the first page of the CBP Form 7501. The deferred I.R. tax amount should not be shown in column 34, block 38, or block 40. Record the letter “V” or “C” followed by the visa/certificate number associated with each line. Visa/certificate numbers are generally nine alphanumeric characters in length. The first character is numeric, the second and third character is alphabetic, and the fourth through the ninth character varies, depending on the trade agreement.

The first position of the visa/certificate represents either the year of export, the year for which the certificate is in effect (e.g. date of presentation), or a grouping such as those required for African Growth and Opportunity Act (AGOA) claims. The second and third positions represent the ISO country of origin code. The fourth through the ninth positions represent a unique number issued by the foreign government. For specific information pertaining to formatting, refer to the Quota Book Transmittals (QBT) that are issued at the beginning of each quota period or to Textile Book Transmittals (TBT). The TBT is issued when new trade legislation or free trade agreements are implemented. These references can be found at:

http://www.cbp.gov/xp/cgov/import/textiles_and_quotas/ If merchandise is covered by more than one visa/certificate, then separate line items must be shown for each visa/ certificate number. All visa numbers and those certificates required to be eligible for a reduced rate of duty associated with a tariff rate quota must be recorded in column 33. The above instructions do not apply to agriculture licenses issued by the U.S. Department of Agriculture. When the country of origin differs from the country of export and the visa/certificate is issued based on the date of export, or the quota is based on the date of export, report the date of export from the country of origin in column 33. The date of exportation from the exporting country will continue to be reported in block 15. For merchandise subject to agriculture licensing, report the license number in column 33 directly below the tariff rate for that line item. The license number will be in a ten-character format, including hyphens and spaces. The two acceptable formats are as follows: (1) N-AA-NNN-N or (2) N-AB-NNN-N (1-cc-234-5) (1-c -234-5) The letters N and A represent numeric and alpha characters respectively. The letter B represents a blank space. For format 1, the first position is the license type. The third and fourth positions are the commodity type code. Positions six through eight represent the license serial number. The tenth position is the license year. Positions two, five and nine are hyphens. Format 2 is identical to the above except position four is blank. Record the estimated duty, AD/CVD, I.R. tax, and any other fees or charges calculated by applying the rate times the dutiable value or quantity. The amount shown in this column must be directly opposite the appropriate HTS rate(s), AD/CVD rate, I.R. rate and other fees or charges. This includes those instances where bonding is permitted for AD/CVD. Where bonding is accomplished, enclose the AD/CVD amounts in parentheses. Where I.R. tax is deferred under 26 U.S.C. § 5232(a), leave blank (See instructions for column 33). Dollar signs are omitted. For entries subject to payment of AD/CVD and/or any of the various fees, each applicable fee must be indicated in this area, and the individual amount of each fee must be shown on the corresponding line. AD/CVD amounts are to be included in the summary only when they are actually deposited. Bonded amounts should not be included. The Block 39 Summary must be on the first page if the entry summary consists of more than one page. The applicable collection code must be indicated on the same line as the fee or other charge or exaction. Report the fees in the format below: There is no de minimis collection for the MPF. There is an established minimum and maximum due on each formal entry, release or withdrawal from warehouse for consumption. Report the actual MPF due unless the perspective amount due is less than the established minimum (record the minimum), or exceeds the established maximum (record the maximum). There is a de minimis on the HMF if it is the only payment due on the entry summary. If such is the case, HMF of $3 or less will not be collected. The grand total user fee in this block should be reported as the total fee amount of all line items, but the amount in block 39 should be reported as $0. Goods originating under a Free Trade Agreement (FTA) may be exempt from MPF. To obtain this exemption, the importer must indicate the appropriate SPI for each HTS number in Column 27. Report the total entered value for all line items. This information is required on all entry summaries. Select the appropriate boxes as it relates to your circumstances as an importer or agent. Record the total estimated duty paid (excluding AD/CVD). Record the total estimated tax paid, including any amount deferred (except tax deferred under 26 U.S.C. § 5232(a)). Record the total estimated AD/CVD or other fees, charges or exactions paid. Do not show AD/CVD amounts that were bonded. The amounts shown in block 39 of the summary should reflect the amounts actually being paid. Record the sum of blocks 37, 38, and 39. Do not include any I.R. deferred tax shown in column 34 and block 38. Do not include any AD/CVD that has been bonded. If no duty, tax, or other charges apply to the transaction, record "0" in this block. HMF is required to be paid on all warehouse entry summaries (type 21), but is not due on re-warehouse (type 22) entries. Record the name, job title, and signature of the owner, purchaser, or agent who signs the declaration. Record the month, day, and year (MM/DD/YYYY), when the declaration is signed. When the entry summary consists of more than one page, the signature of the declarant, title, and date must be recorded on the first page. Certification is the electronic equivalent of a signature for data transmitted through ABI. This electronic (facsimile) signature must be transmitted as part of the entry summary data. This block is reserved for a broker or filer name, address and phone number. This block is reserved for a broker or importer internal file or reference number.

Informal Entries

Warehouse Entries

Warehouse Withdrawal

Government Entries

For merchandise arriving in the customs territory from a U.S. FTZ, leave blank.